Central Balance Sheet

The National Institute of Statistics and Economic Studies (STATEC) is the manager of the Central Balance Sheet (CBSO). The CBSO archives and publishes the financial data of Luxembourg companies and traders subject to the online filing of their annual accounts on the electronic platform for the collection of financial data (eCDF) and STATEC uses the data of the CBSO internally for the establishment of statistics. The Ministry of Justice and STATEC collaborate within the Accounting Standards Commission (Commission des Normes Comptables - CNC) on the various aspects related to the electronic filing of annual accounts - e.g. Standardized Chart of Accounts (SCA), eCDF validation forms and rules, legislation and regulations.

Need help?

Helpdesk Central Balance Sheet

- Tel.: (+352) 247-88494

- E-mail: centralebilans@statec.etat.lu

News 2021/2022

Introduction of the 2020 SCA and the transition tables

Following the introduction of the Grand-Ducal regulation of September 12, 2019 determining the content of the standardized chart of accounts, the use of a transition table is required for annual accounts starting after 04.01.2021. On the CNC website you will find the trilingual comparison table SCA 2009 vs. SCA 2020, a transition table and mappings to the annual accounts (in Excel format) - September 2019.

Dissemination of data from the Central Balance Sheet Office

Since 2021, the CBSO publishes non-confidential financial data in a structured form, i.e. the files disseminated on the data.public.lu portal can be read by software. The user will also find instructions on how to use the accounting data in XML language. Datasets can contain several million rows in XML format and it is therefore necessary to have adequate software in order to use, process and/or display all of these records.

Sources of important information

Website of the Accounting Standards Commission (CNC)

- Questions / Answers (Q&A) and opinions of the CNC

- Chart of accounts & standardized collection (PCN & eCDF)

As well as the Grand-Ducal Regulation of September 12, 2019 determining the content of the standardized chart of accounts referred to in Article 12 of the Commercial Code and its predecessor, the Draft Grand-Ducal Regulation determining the content of the standardized chart of accounts referred to in the Article 12 of the Commercial Code and repealing the Grand-Ducal Regulation of June 10, 2009 determining the content and presentation of a standardized chart of accounts - June 2018 - in the explanatory memorandum to the draft regulation, there are many information relating to the modification of positions in the old 2009 SCA (explanations, reasons and practical advice).

Website of the eCDF platform:

FAQ

1. Technical questions addressed to the CBSO Helpdesk

1.1. Questions about "SPF (formerly Soparfi)" Forms

!!! Repeal of SPF forms since 2016 !!!

1.1.1. Who can/should use these forms?

The advice note CNC 1-1 limits this specific scheme only to holding companies 1929 (whose regime is now abrogated) and by extension to “sociétés de gestion de patrimoine familial (SPF)” (private asset management company) introduced by the Act of 11th May 2007. Therefore cannot use this scheme the commercial companies commonly referred to as "SOPARFI" which must use the schemes for their balance sheets as provided by Article 34 (full or abridged).

1.1.2. The SPF balance sheet (Formerly Soparfi) does not contain the item "Interim dividends" - in which item of the balance sheet this value should be registered?

The balance sheet applicable to holding companies (Art.31 and advice L.19/12/2002 1-1 CNC) will not specify during its adoption in 1984, a specific account for the interim dividend and has not been changed since then.

Regarding the classification of interim dividends, it is - in the current context - up to the direction of the management of the “Sociétés de gestion de patrimoine familial (SPF)” (private asset management company) to determine the most appropriate classification to the case in question. Without this having any normative scope, it seems that a possible solution is to deduct the amount of the advance directly from the account of which it is collected. It may be, for example the account A.IV.4. "Other reserves" or A5. "Retained earnings" if the distribution of the interim dividend is paid out of reserves and retained earnings from previous years. It may also be the position E. "Net profit" if it is a true interim dividend from the profits of the year, although in this latter case, such accounting choice has the effect of disconnecting the concept of the profit of the year (shown in the profit and loss account) and the concept of profit of the year - implying "undistributed profit of the year" (as emerged from the balance sheet).

1.2. Questions relating to the allocation of accounts of SCA in sections of the annual accounts

1.2.1. Is there a document specifying the accounting links - so the imputations from the accounts of the SCA in different sections of the “Balance sheet” and "Profit and Loss" forms?

A distinction must be made between annual accounts with a financial year beginning before 04.01.2021 and after 04.01.2021:

Before: no standardized transition table, there was a "natural" transition table that had no normative scope, but resulting from the fact that the PCN positions are grouped together under headings or sub-headings whose title are similar or identical to that of the balance sheet and profit and loss account items.

After: following the introduction of the Grand-Ducal regulation of September 12, 2019 determining the content of the standardized chart of accounts, the use of a transition table is required for annual accounts starting after 04.01.2021.

Accounting year beginning between 01.01.2019 and 31.12.2019

Forms 2019:

- Balance sheet

- P&L Account

- SCA (based on RGD 2009, but new variable: job to be filled in)

Accounting year beginning between 01.01.2020 and 31.12.2020 and filed BEFORE 04.01.2021

Forms 2020:

- Balance sheet

- PP Account

- PCN (based on GDPR 2019)

Accounting year beginning between 01.01.2020 and 31.12.2020 and filed AFTER 04.01.2021

Forms 2020:

- PCN (based on RGD 2019 and new variables: for generation of balance sheet and P&L account)

- Transition table

1.2.2. Specific case: into which section of the "Abridged profit and loss account" form should we classify the account 781 "Adjustment of wealth tax” from the SCA?

Concerning the item 781 "Adjustments of wealth tax" of the SCA, a classification in the abridged profit and loss account under the item A.11 "Other taxes not included in the previous caption” could be justified. It is however not mandatory and other alternative classifications may also be justified on the basis of the particular case.

1.2.3. Specific case: in what position of the form “Balance sheet” may allocate the sub-accounts under account 33 "Land and buildings held for resale" from SCA...?

These accounts may be affected within the item D.I.3 "Stocks - Finished goods and goods for resale" of the balance sheet. It is however not mandatory and other alternative classifications may also be justified on the basis of the particular case.

1.3. Questions relating to validation rules

1.3.1. Does the exclusion rules in different fields in the abridged profit and loss account are valid?

Pursuant to Article 47 of the amended law of 19 December 2002, small and medium-sized enterprises have the ability to establish an abridged profit and loss account in which appears a "gross margin" called "gross revenues" if the margin is positive or "gross charges" if the margin is negative.

In the abridged profit and loss account and for the same period, the net gross margin appears either as gross revenues or gross charges but never in both positions because it is a margin or a result of the deduction of charges with incomes, or vice versa.

Accordingly, it should be noted that:

- the fields 643 and 739 are mutually exclusive -> it will be either one or the other but not both

- the fields 644 and 740 f are mutually exclusive -> it will be either one or the other but not both

Section 47 subsection (1) paragraph 2 stipulates :

"may derogate from the layouts prescribed by the Article 46 by aggregating the headings A 1, A 2 and B 1 to B 4 included under one unique item called "Gross revenues" or "Gross charges" as appropriate."

- rules stipulating that the field 643 and the field 739 are mutually exclusive.

- rules stipulating that the field 644 and the field 740 are mutually exclusive.

1.3.2. An error message is blocking the validation of the abridged profit and loss account losses. What does it do?

Reference to the previous question. One should fill only one of the fields, as it is to inform the margin, either negative or positive. Do not put the value "0" in the unused field.

1.3.3. What if in some cases, the "customers" headings have a credit balance?

Put a negative debt on to the assets side of the balance sheet is not allowed. Therefore, one must indicate the amount on the liabilities side of the balance sheet (the choice of the allocation of the amount is free to the company).

1.3.4. Is there a integrity check between the SCA form and the balance sheet and/or profit and loss account forms?

Before 2021, the validation rules only applied to a single file (balance sheet, profit and loss account or SCA) and there was no control between the different forms. From the introduction of the transition table in 2021, balance sheets and profit and loss accounts are now generated based on the information contained in the SCA.

1.3.5. The result for the year should it be entered in the "SCA" form?

We must distinguish here, the PCN forms from the years 2012 to 2019 (SCA 2009) and the forms from the SCA 2020.

The SCA 2020 form must show:

- the balances of class 6 and 7 accounts before they are cleared at the close of financial year N;

- an account 142 "Result for the financial year" (as renumbered) equal to zero within class 1 (the latter being funded only during the transfer for balance of class 6 and 7 accounts);

- the sum of the debit amounts for classes 1 to 7 equal to the sum of the credit amounts for classes 1 to 7;

- the balance of classes 1 to 5 (difference between the total of debit amounts and the total of credit amounts) equal to the balance of classes 6 and 7 (difference between the total of credit amounts and the total of debit amounts) corresponding to the result of the financial year ;

- the result of the financial year at the end of the form (not included in the general balance) automatically calculated by deduction (balance of classes 1 to 5 and balance of classes 6 and 7).

The situation before the introduction of SCA 2020 was different and described below:

The SCA form must inform the result of the year under the account 142 "Result for the financial year", the balance of the account will be “debtor” (field 0161) in case of a loss and “creditor” (field 0162) in case of a profit.

"Total classes 1-5" is an automatically calculated balance and its values appearing in the fields 1111 or 1112 must be zero (0.00), this balance is showing the equality between the assets and liabilities of the balance sheet.

"Total classes 6 and 7" is an automatically calculated balance and its values must be equal to the

difference between the incomes and the expenses items. This balance must therefore correspond to the amount of the result for the period specified under the account 142, amount that will appear in the field 2257 in case of loss or in the field 2258 in case of a profit.

1.4. Questions relating to the scope of the electronic filing of the accounting package

On this subject, download the CNC comparative table “Filing of financial data to RCS and publication of annual accounts”.

1.4.1. Are pharmacies subject to the filing of annual accounts with the RCS?

In Luxembourg, the pharmacies are considered as being business persons who are subject to registration with the RCS and to the filing of accounts (the annuals accounts will however not be published). The article 13 of the Law of 19 December 2002, however, provides that business persons whose turnover of the last year does not exceed 100.000 EUR VAT excluded have the option of not filing the annual accounts.

1.4.2. Is a PFS, under control of the CSSF (filing of financial data electronically and encrypted way) is required to file financial information via eCDF?

In the current text, the financial companies subject to the prudential supervision of the CSSF as professionals of the financial sector (PFS) within the meaning of the law of 5 April 1993 are not required to prepare their accounting documents through the eCDF platform and are therefore excluded from the collection of their accounting information in a structured format. Therefore, these companies will continue to make a "classic" filing of their annual accounts and related documents to the RCS.

In this regard, it is appropriate to note that all deposits including "classic" will now be made electronically on the register of commerce and companies website.

1.4.3. For PLC under Luxembourg law, a deposit of annual accounts but also consolidated accounts must be done. The distinction of the accounting documents was at the mention, how this will be handled via the platform eCDF?

The collection procedure of structured accounting information does not concern the consolidated financial statements. Therefore, no prior preparation on the eCDF platform will be required for the consolidated accounts.

The consolidated financial statements and related documents (e.g. Consolidated management report, audit report) will continue to be a "classic" deposit (unstructured format) directly to the RCS. This deposit will be made electronically on the RCS website; "paper" deposits are no longer accepted since the beginning of 2012.

In summary, the individual financial statements and the consolidated financial statements will continue to be the subject of separate deposits; the new eCDF platform only concerns the (individual) financial statements.

1.4.4. Under what circumstances should the complete forms of the balance sheet and the profit and loss account be used and when could the abridged forms be used?

For companies establishing their individual accounts the ability to use the abridged balance sheet and / or profit and loss account is determined by size criteria.

a. Small businesses can file an abridged balance sheet and profit and loss account

Belonging to the category of small businesses is determined on the basis of size criteria referred to in Article 35 of the amended law of 19 December 2002, namely:

- balance sheet total: EUR 4.4 million

- net turnover : € 8.8 million

- number of staff employed full- time and average during the year: 50.

To qualify as a small business, the company must not exceed the figures of two of the three criteria mentioned above, it’s being understood that to produce its effects, exceeding or not the thresholds should be repeated for two consecutive years.

Small businesses can file an abridged balance sheet and an abridged profit and loss account, but are free to submit full versions of the balance sheet and / or profit and loss account.

b. Medium-sized companies can file an abridged profit and loss account

Belonging to the category of medium-sized companies is determined on the basis of size criteria referred to in Article 47 of the amended law of 19 December 2002, namely:

- balance sheet total: EUR 17.5 million

- net turnover : 35 million euros

- number of staff employed full- time and average during the year: 250.

To be considered as a medium-sized company, the company shall not exceed the figures of two of the three criteria mentioned above, it’s being understood that to produce its effects, exceeding or not the thresholds should be repeated for two consecutive years.

Medium-sized companies can file an abridged profit and loss account, but must file a complete balance sheet. They are free to submit the full version of their profit and loss account.

c. Large companies and listed companies cannot file abridged versions of the balance sheet and profit and loss account

Companies that do not meet the size criteria relating to small and medium enterprises belong to the category of large companies.

Be counted among the big companies or companies making public offerings on a regulated market in the EU regardless of the size of the company in question.

Large companies cannot use abridged versions and therefore must file a complete balance sheet (art. 34) and a complete profit and loss account (art. 46).

1.4.5. Some companies waive from the structures of the balance sheet and profit and loss account (Articles 34 and 46 of the Law of 19th December 2002) by invoking Article 26 of the same Law, ... ?

As of January 1st, 2012, the filing of annual accounts approved with the Register of Commerce and Companies will be exclusively on the basis of standardized forms as listed on the eCDF platform for companies that fall within the scope of application. Access to financial statements for the public (for companies subject to the publication) will be on the annual accounts as filed. It is however also open to companies to establish for their partners / shareholders or other stakeholders (e.g., banker, etc.) financial statements established under a separate format of the standardized format. These financial statements do not constitute financial statements within the meaning of the filing requirement and publicity referred to the Articles 75 and following of the amended law of 19 December 2002.

1.4.6. Some traders operate two separate businesses - should/can they file two sets of accounts?

Both businesses have different VAT numbers. The individual trader keeps two separate accounts and the question arises whether it should/may file under eCDF two sets of financial statements or whether to consolidate it into one set of accounts?

Technically, it is impossible to try to prepare two sets of accounts on the eCDF platform and wish to file two sets of accounts for a single trader registered with the RCS (i.e. with only one RCS number given). One single set of accounts should be filed this is confirmed by the following legal texts:

- art. 8 of the Commercial Code says that the physical person trader is a company;

- art. 9 of the Commercial Code says that every company shall keep one accounting;

- art. 10 of the Commercial Code says that the accounts of the individual trader must cover all of their operations, their assets and rights of any nature, debts, obligations and liabilities of any kind when they fall within their business;

- art. 15 al. 1 of the Commercial Code says that a company must establish one comprehensive inventory of its assets and rights of any nature and of its debts, obligations and liabilities of any kind once a year;

- art. 15 al. 2 of the Commercial Code says that the accounts of the company are summarized in one descriptive statement constituting the financial statements.

From a conceptual point of view, the balance sheet represents the "commercial" property / assets of the company - this property is unique (principle of unicity of property) or in terms of the Civil Code:

- Art. 2092 of the Civil Code: "Whoever engaged itself personally must fulfil its commitment by all its movable and immovable goods, present and future." ( the balance sheet must be an accounting representation of all the debtor's assets ... assigned to its business in the case of an individual trader);

- Art. 2093 "The property of the debtor is the common pledge of his creditors” (the balance sheet should be a representation of all the debtor's assets assigned to the business in the case of an individual trader).

For every legal person with a unique property that meets commitments, the accounting representation of this property - namely the balance sheet - must also be unique.

1.5. Questions concerning the use of languages

1.5.1. Does the consolidated financial statements of the mother company must be filed in the same language as that in which the statutory annual accounts of the company are established?

The filing of the individual annual accounts and the consolidated financial statements are analysed as two separate deposits in relation to the process of collection of accounting information. Therefore, the language used for the individual annual accounts may differ from that used for the consolidated accounts provided that :

- one of the three accepted languages (French, German, English) is used and that

- one and the same language is used within the same set of accounts – e.g.: French for all the forms used in the individual annual accounts and English for all the documents contained in the consolidated accounts.

1.6. Questions concerning the dates of the year

1.6.1. The period of the year begins in 2010 and ends on 31/12/2011. Should we go through the eCDF platform?

The financial year of the company beginning in 2010, the platform should not be used and the company will have to deposit a classic (but an electronic) financial statement with the RCS. The first use of the eCDF platform will therefore be financial years running from 01/01/2011 and subsequent years.

1.6.2. The 2010 financial year, already filed with the RSC, cannot be reproduced in detail on the forms of the eCDF platform - what to do?

It is necessary to enter only the totals of the positions for which the breakdown is difficult.

1.7. Questions concerning the eCDF platform

For more information about the eCDF platform (questions of access requests, management of mandates, eCDF use or technical questions), please contact the State Information Technology Center (CTIE):

- Tel.: (+352) 24 78 1677

- E-mail: ecdf@ctie.etat.lu

- Link to the platform eCDF: http://www.ecdf.lu

1.8. Other questions

1.8.1. Why do the collection forms of balance sheets and profit and loss accounts require, in addition to the figures of the current year, also the figures of the previous year?

Both European legislation (4th Directive 78/660 / EEC1) and national legislation (amended law of 19 December 20022) require that the annual accounts include, alongside the figures relating to the current year, those relating to the previous year. This legal requirement is justified through one of the main objectives pursued by European and Luxembourg accounting law, namely to inform partners and third parties about the evolution of the financial situation of the company, an evolution which cannot be to be appreciated only over time (temporal comparability) and which must be instantly accessible within synthetic documents.

At European level, Article 4 paragraph 4 of 4th Directive 78/660 / EEC provides as follows:

“4. Each of the balance sheet and profit and loss account items must include an indication of the figure relating to the corresponding item for the previous year. Member States may provide that, where these figures are not comparable, the figure for the previous financial year must be adjusted. In any case, the lack of comparability and, where appropriate, the adaptation of the figures must be indicated in the appendix and duly commented ”.

At the national level, Article 29 paragraph (4) of the amended law of 19 December 2002 proposes a faithful transposition of the European text, by providing that:

"(4) Each of the balance sheet and profit and loss account items must include an indication of the figure relating to the corresponding item for the previous year. The lack of comparability of figures from one financial year to another and, where applicable, adjustments to the figures for the previous year, made to ensure this comparability, must be pointed out in the annex and duly commented on ".

The column relating to the figures for the previous year is not pre-filled by the CTIE3 (for PDF forms) on the basis of the figures submitted by the company during the previous year. It’s the responsibility of the company to enter, and, if necessary, modify the comparative figures when said figures have been adapted - in accordance with the legal provisions - for the purposes of comparability. It should be noted that such an adaptation has no effect on the figures filed in the annual accounts for the previous year. It is therefore up to the company to determine whether or not to make a corrective filing.

------------------------

[1] Fourth Council Directive of 25 July 1978 based on Article 54 (3) (g) of the Treaty and on the annual accounts of certain types of companies (78/660 / EEC).

[2] Law of 19 December 2002 on the trade and company register as well as the accounting and annual accounts of companies.

[3] The State Information Technology Center (CTIE) is the manager of the electronic financial data collection platform (eCDF).

1.8.2. Are companies, wishing to submit for publication an annual report in a different format as those proposed by the eCDF platform, allowed to do so?

A negative answer is indicated: in fact, the balance sheet and the profit and loss account as prepared and validated on the eCDF platform are together with the unstructured notes (and any other optional financial documents) the legal statutory annual accounts, whose deposit is required at the RCS and are - if applicable – available to the public.

The Grand Ducal Regulation of 14 December 2011 called "GDR accounting package" did not provide the opportunity for a company to make a distinction between on the one hand, an administrative filing in a structured format and, on the other hand, a public filing made in free format. Companies therefore cannot file two sets of annual accounts: one for administrative purposes and the other for publication.

It remains, however, free to the company wishing to establish an annual report (under a different format as that structured format of the eCDF platform) for financial reporting and dissemination e.g. for its banker, its creditors and other stakeholders or to put it online on its website. Note however that this annual report does not constitute the legal statutory financial statements.

1.8.3 What are the financial statements on which the certified auditor must perform the statutory audit and issue the audit report?

To the extent that the legal statutory annual accounts are those deposited with the RCS and that the balance sheet and the profit and loss account which compose it, were prepared and validated on the eCDF platform, those are the legal statutory annual accounts and therefore must be logically be under the focus of the statutory audit and the basis for the report of the independent auditor.

In the case of different publication channels - other than the RCS - of an annual report of the company that includes the elements of financial statements in a different format and incorporating the report of the certified auditor, it will return to the professional auditor to apply the procedures that he considers being appropriate in accordance with its professional standards to ensure that the information so reproduced is consistent with the one on which it is expressed.

1.8.4. The new application procedure does not seem to respect the usual order of the components of the financial statements, e.g. balance sheet, profit and loss account and notes. What’s the point?

The amended law of December 19, 2002 specifies the components of the annual accounts. The practice effectively consists of first including the balance sheet, then the profit and loss account, then the notes.

The deposit notice appears on the first page, followed by the structured elements intended for publication, namely the balance sheet and, where applicable, the profit and loss account. Following these documents is the unstructured file prepared by the company. In this regard, it should be noted that the order in which these documents appear is the order in which the company has compiled and filed its unstructured file. It is therefore up to the company to determine in which order the documents will appear, the RCS not modifying the order of the documents filed by the company.

As an indication, companies may proceed as follows, which will allow a logical order to be observed and broadly in line with previous practice, namely the balance sheet, the profit and loss account and the notes.

4. Other accounting documents to be published: (1 single unstructured PDF/A file)

A circular issued by the RCS specifies that the order of the documents in which the company submits its PDF / A file will be the order in which the documents appear once the elements of the package have been aggregated and the filing accepted by the RCS.

This circular is available at the following link: Circular RCSL 12/001

The depositor is strongly advised to first attach the legal notes, then the management report and that of the person responsible for auditing the accounts and finally any other document relating to the accounts.

1.8.5. How to complete the "Reference (s)" column included in the "Balance sheet" and the "Profit and Loss account” forms?

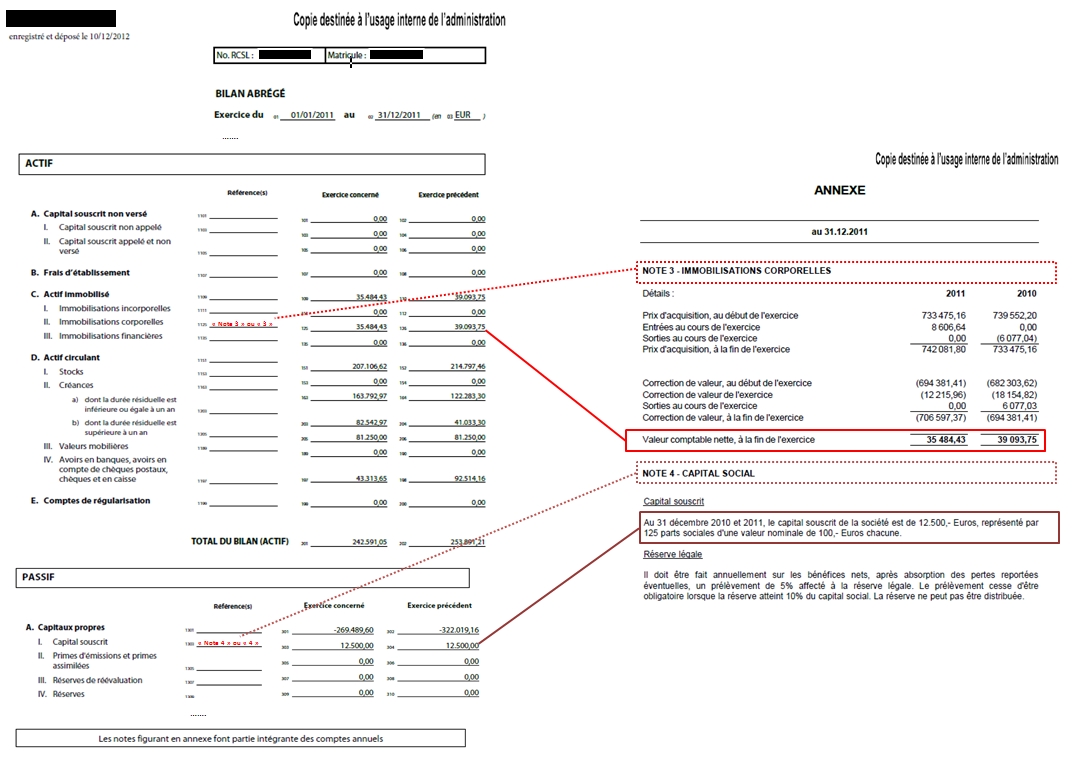

This column can be used to make an indication in relation to the information contained in the legal notes to the financial statements which form an integral part of the official publication of the accounting package to RCS. Inside the eCDF forms, this column will, if necessary, indicate possible references to specific chapters in the notes and concerning items provided in the balance sheet and / or profit and loss account to make available additional information to the user of the financial statements.

1.8.6. Provisions concerning the late filings and applicable from 1st January 2017

In accordance with the circular RCSL 16/003, the persons who have not completed the filing of their financial data within the time limit as prescribed by law, will bear an increase of the filing fees. These increased costs are fixed by Grand-Ducal regulation and relate to financial data repositories.

Thus, the appreciation of the lateness of the deposit depends on two objective criteria:

- The date on which the applicant submits his filing request for the accounts to the RCS and

- The maximum period of seven months required by law to deposit accounts, from the closing date of the financial year for companies or that of the calendar year for individual business persons, subject to the obligation of depositing accounts.

Concretely,

- If the filing request is made with a delay of 1 month, the filing fee is 50€,

- If the filing request is made with a delay of 2-4 months, the filing fee is 200€,

- If the filing request is made with a delay of more than 4 months, the filing fee is 500€.

For further information: Circular RCSL 16/003 (French version)

1.8.7. The balance sheet and profit and loss account layouts have been modified for the reference year 2016 – what are the practical consequences?

Dernière modification le